Unlocking Success: Exploring Strategy Pocket Option

In the realm of online trading, mastering the strategy pocket option strategy pocket option can make a significant difference in your trading journey. The Pocket Option platform provides a user-friendly interface and a variety of trading tools, making it an excellent choice for both new and experienced traders. In this article, we will delve into effective trading strategies on Pocket Option, focusing on risk management, technical analysis, and the importance of having a trading plan.

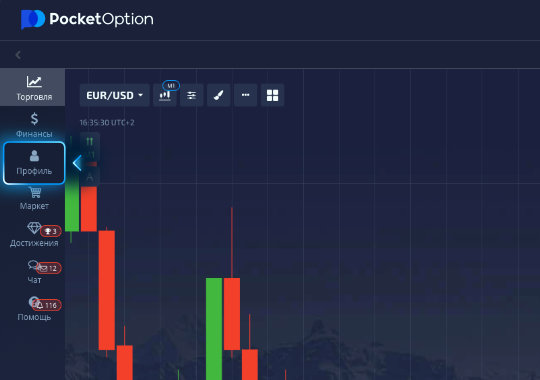

Understanding Pocket Option

Pocket Option is a fast-growing trading platform that allows traders to access a wide range of financial instruments including forex, cryptocurrency, commodities, and stocks. What sets Pocket Option apart is its simplicity and accessibility for traders. The platform offers a demo account, which is an invaluable resource for beginners looking to practice without risking real money.

The Importance of Strategy

Having a well-defined strategy is crucial in trading. Without a strategy, traders can easily fall into the trap of emotional decision-making, which often leads to losses. Strategies can vary widely; however, they typically include elements such as technical analysis, fundamental analysis, market sentiment, and risk management. A comprehensive strategy takes into account all of these factors, leading to more informed trading decisions.

Technical Analysis

Technical analysis is one of the most popular strategies in trading, including on the Pocket Option platform. It involves analyzing historical price data to identify patterns and trends that can inform future price movements. By utilizing various technical indicators, traders can make educated guesses about where the market might be headed.

Key Technical Indicators

- Moving Averages: These help smooth out price data and can indicate trends.

- Relative Strength Index (RSI): An oscillator that measures the speed and change of price movements, helping identify overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): A trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

Risk Management

Risk management is a crucial aspect of trading that every trader should prioritize. It involves understanding how much capital you are willing to risk on each trade and employing strategies to minimize potential losses. Some common risk management strategies include:

- Setting Stop-Loss Orders: These orders automatically close a position when it reaches a certain loss threshold, helping to limit losses.

- Position Sizing: Determining the appropriate amount to invest in a single trade based on your overall account size and risk tolerance.

- Diversification: Spreading investments across different assets to reduce risk exposure.

Creating a Trading Plan

One of the most vital components of successful trading is having a trading plan. A trading plan is a comprehensive guide that includes your trading goals, risk tolerance, strategies, and evaluation procedures. This plan serves as a roadmap for your trading activities and can help keep your emotions in check. Here are essential elements to include in your trading plan:

- Trading Goals: Define your objectives, whether it’s short-term gains or long-term investments.

- Market Analysis: Include your approach to market analysis, whether technical, fundamental, or both.

- Money Management Rules: Establish rules for risk management, including how much capital to risk on each trade.

- Review and Adjustments: Schedule regular evaluations of your trading performance and adjust your plan as necessary.

Utilizing Demo Accounts

Before diving into live trading, it is wise to start with a demo account. Pocket Option offers a demo account that allows you to practice your strategies in a risk-free environment. This practice can help you refine your trading skills and test your strategies without the risk of losing real money. It’s an excellent step for beginners to gain confidence and for experienced traders to trial new strategies.

Final Thoughts

Trading on the Pocket Option platform can be both exhilarating and challenging. By developing a solid strategy pocket option, incorporating technical analysis, emphasizing risk management, and adhering to a structured trading plan, you can enhance your chances of success. Remember that trading involves risks, and even the best strategies will not guarantee profits. However, by arming yourself with knowledge and skills, you can navigate the trading landscape more effectively and work towards achieving your financial goals.

With dedication and perseverance, you can harness the power of effective trading strategies and make the most out of your Pocket Option experience.

APR

About the Author