This not only aids in the calculation process but also makes the data more comprehensible when revisiting the analysis or presenting it to stakeholders. There are two different calculations that you can use to determine the profitability index. It doesn’t matter the type of business that you operate or the industry that you are in. It also doesn’t matter if you’re a sole trader or a limited liability partnership. Generating profit and increasing that profit margin is the difference between keeping your doors open or closed. Step 2) As the rate argument, supply the WACC over which the cashflows are to be discounted.

Formula for Profitability Index

The net present value analysis favors project 1 because its NPV number is bigger than project 2. But the profitability index indicates otherwise and says that project 2 with its higher PI value is a better opportunity than project 1. For example, if a project costs $1,000 and will return $1,200, it’s a “go.” A helpful tip is to keep the layout of the spreadsheet clean and organized.

Why PI Matters in Investment Decisions

- This is invaluable for long-term strategic planning, where misallocation can mean loss of capital and opportunity.

- The profitability index however can not be a negative number, it can be less than 1 or greater than 1.

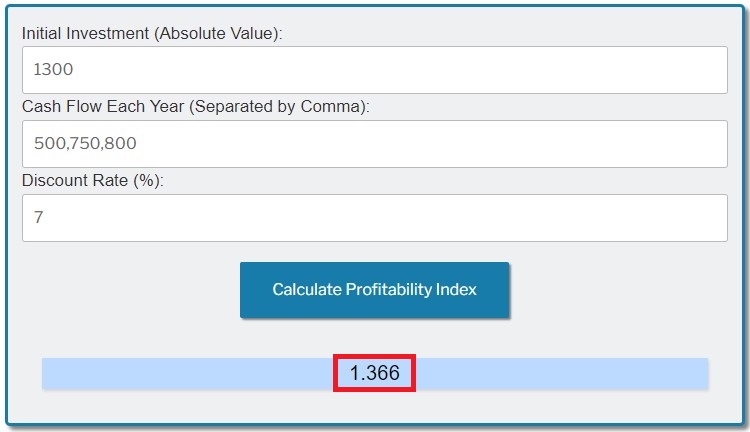

- The Profitability Index Calculator simplifies this process by providing a straightforward numeric value that investors can use to evaluate the potential returns of a project.

- For example, the Profitability Index can be instrumental in scenarios such as capital rationing, where we must decide the most efficient way to deploy limited resources.

Other names used for profitability index are the value investment ratio (VIR) and the profit investment ratio (PIR). The profitability index can help you determine the costs and benefits of a potential project or investment. It’s calculated based on the ratio between the present value of future cash flows and the initial investment. If a PI is less than 1, it suggests that the project’s present value is less than the initial investment, indicating it’s unprofitable and should typically be rejected. The profitability index (PI) helps measure the attractiveness of a project or investment. It is calculated by dividing the present value of future expected cash flows by the initial investment amount in the project.

Quantifying the value of your investments with profitability index calculator

The initial investment is the starting point of any project or investment, representing the total of all costs incurred to commence the venture. This can range from purchasing equipment to initial research and development costs. Handling different types of initial investments requires understanding their nature – whether they are one-time costs, recurring expenses, or a mix of both. The importance of PI in investment decision-making cannot be overstated.

How to Calculate Profitability Index in Excel (Easy)

A profitability index or ratio below 1 indicates that the project should be abandoned. As mentioned above, having a profitability index higher than 1 is ideal. You will then have to make a decision on what’s going to be best for your business moving forward. The result can be a higher return states with the highest sales tax rates in the usa on investment and an increase in potential profitability. Anything lower than that is going to indicate that a project’s present value is going to be far less than the initial investment. So, as the profitability index value increases, so will the financial benefits of the potential project.

The new factory project is expected to cost $2 million and generate cash flows of $300,000 per year for the next 5 years, also with a discount rate of 10%. A ratio of 1 indicates that the present value of the underlying investment just equals its initial cash out outlay and is considered the lowest acceptable number for a proposal. A less than 1 PI ratio means that the project’s present value would not recover its initial investment or cost.

By examining the PI, we quickly identify which project offers a better return per dollar invested over its lifespan. This is invaluable for long-term strategic planning, where misallocation can mean loss of capital and opportunity. The numerator, the present value of future cash flows, is the sum we expect to receive over the project’s lifespan, discounted back to present value using our required rate of return. This accounts for the time value of money, a crucial principle in finance that reflects the idea that money available today is worth more than the same amount in the future due to its earning potential. The Profitability Index Calculator offers numerous benefits to investors seeking to evaluate investment opportunities. Firstly, it provides a clear and objective measure of a project’s profitability, allowing investors to compare and prioritize different ventures.

The formula for Profitability Index is simple and it is calculated by dividing the present value of all the future cash flows of the project by the initial investment in the project. As the financial world continues to evolve, the PI remains a timeless and essential tool, illuminating the path to prudent and profitable investments. Before diving into the calculations, preparing the spreadsheet is crucial to make the process seamless. Under ‘Year,’ list each year of the project duration, beginning with year 0 for the initial investment, which is logged as a negative value. We found out all of the above-discounted cash flows by using the same method. Only the cost of capital changed due to the increase in the number of years.

Therefore, the project is worth investing since then it is more than 1.00. Each scenario will demonstrate how PI varies with different investment scales and cash flow patterns. For instance, if the PI ratio of an investment is 2, then it falls under the excellent category, which means that the investment is highly profitable.

In the realm of financial decision-making, evaluating the potential profitability of an investment project is paramount. This invaluable tool provides users with a numeric value that represents a project’s profitability relative to its initial investment. The Profitability Index (PI) or profit investment ratio (PIR) is a widely used measure for evaluating viability and profitability of an investment project. It is calculated by dividing the present value of future cash flows by the initial amount invested. If the profitability index is greater than or equal to 1, it is termed a good and acceptable investment.

Since you’ll be able to earn more than what you invest, the PI for this project is 1.56 (more than 1). A negative number divided by a positive number results in a negative output. However, the numbers needed to be able to perform that division operation might be a little bit of science to calculate. Let me show you an example of performing this calculation from start to end. Let’s take a look at some examples of PI calculations to help you understand how it works. If you don’t fancy calculating the present value manually, you can use the present value calculator here.

JUN

About the Author