Investment decisions are often complex, involving multiple variables and considerations. The Profitability Index Calculator simplifies this process by providing a straightforward numeric value that investors can use to evaluate the potential returns of a project. Armed with this information, decision-makers can assess risk-reward ratios, weigh the merits of various investment opportunities, and make informed choices aligned with their financial goals.

Profitability Index (PI) Rule: Definition, Uses, and Calculation

The projects having more chances of generating profits is the project that the firms are likely to choose. As the value of the profitability index increases, so does the financial attractiveness of the proposed project. If the PI is less than 1, it means you will not even recover your initial investment. It helps you forecast the returns and feasibility of a project to see if it is even worthwhile to invest. Profitability index is a technique to evaluate the viability of investments/projects.

Types of PI Calculations

Calculations greater than 1.0 indicate the future anticipated discounted cash inflows are greater than the anticipated discounted cash outflows. Calculations less than 1.0 indicate the deficit of the outflows is greater than the discounted inflows, and the project should not be accepted. For example, a project that costs $1 million and has a present value of future cash flows of $1.2 million has a PI of 1.2. The Profitability Index is highly useful in project evaluation because it not only assesses the relative profitability of projects but also considers the scale of the investment. It allows us to rank competing projects based on the value they add per invested dollar, helping to identify the most efficient use of limited capital. PI is particularly beneficial in capital budgeting to evaluate the desirability of investments or projects with constrained funding.

Preparing Your Spreadsheet for the Calculation

The profitability index rule is a variation of the net present value (NPV) rule. In general, a positive NPV will correspond with buying a house with family a profitability index that is greater than one. A negative NPV will correspond with a profitability index that is below one.

So, the higher the profitability index, the more benefit and value you will get from it. It works as a way for you to appraise a project to make a more informed decision. To find more attractive investments, look for a profitability index that is the highest. This shows that the project will generate value for your business and it can be a good investment. Amidst various analytical tools, the Profitability Index (PI) emerges as a key player.

- Firstly, it provides a clear and objective measure of a project’s profitability, allowing investors to compare and prioritize different ventures.

- As per the formula of the profitability index, it can be seen that the project will create an additional value of $1.003 for every $1 invested in the project.

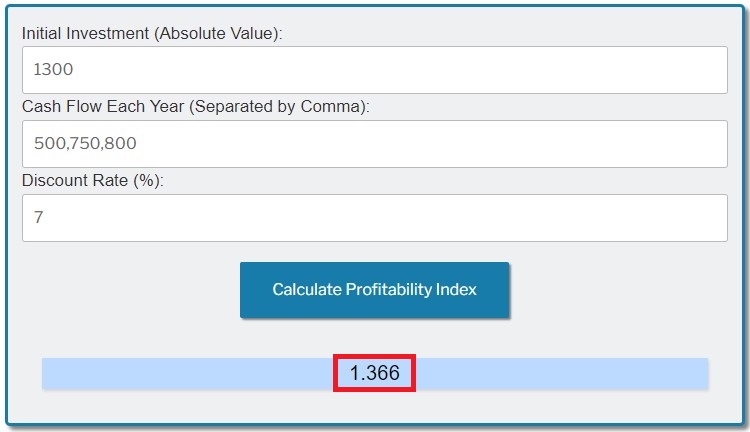

- It is calculated by dividing the present value of future expected cash flows by the initial investment amount in the project.

- As mentioned above, having a profitability index higher than 1 is ideal.

iCalculator™ Finance Home

When applying the PI technique to check on the profits expected from a project, it is recommended to not consider the size of the project. It is because there are instances where there re larger cash flows, but then the PI is limited due to the restricted profit margins. Hence, it is important to be wise when implementing this technique for accurate results. A profitability index greater than 1.0 is often considered a good investment, as the expected return is higher than the initial investment.

However, even if the PI is widely used for doing cost-benefit analyses, it is not free of demerits. As every good side has its limitations, PI also has a couple of limitations. However, there is another way through which we can express PI, and that is through net present value.

A PI greater than 1.0 is considered a good investment, with higher values corresponding to more attractive projects. The Profitability Index (PI), also known as the Profit Investment Ratio (PIR) or Value Investment Ratio (VIR), is a financial metric used to evaluate the desirability of a project or investment. It is calculated as the ratio of the present value of future cash flows to the initial investment required for the project. However, as with any analytical tool, the key to harnessing the full potential of the Profitability Index lies in its careful application. Accurate estimation of future cash flows, prudent selection of a discount rate, and thorough consideration of all initial investment costs are critical to deriving a meaningful PI. Moreover, understanding the limitations and context-specific nuances of the PI ensures that it is employed effectively, avoiding the pitfalls of misinterpretation.

JUN

About the Author