Accounting ratios are important because they assist the management in their day to day financial decisions. They also help them evaluate the performance of the firm and make any changes that are deemed necessary. One aspect that the management has to focus on is to ensure that the firm maintains a certain level of liquidity. Considering this ratio can help a company optimize its management efficiency. The management can work towards the betterment of its working capital requirements. The ratio provides a complete idea of the operating system of the concerned company.

Liquidity Ratios: Definition, Importance, Types, Example, Factors, Limitations

Brokerages occasionally need to raise capital through share issuance or debt to bolster their liquidity coverage ratios. Having a robust LCR above fully-phased-in requirements provides a further cushion against market turbulence. This means the company has Rs.0.70 of cash and cash equivalents available to cover each Rs.1 of current liabilities. A lower ratio indicates potential liquidity problems, while a higher ratio provides a cushion for paying obligations. The debt-to-assets ratio is another solvency ratio used to assess a company’s ability to pay off its debts. This measures the proportion of total liabilities to total assets owned by the company.

Real-world Applications and Examples for Liquidity Ratios

Easily convertible (in cash) marketable securities and present holding of cash are considered while calculating the quick ratio. Any current ratio lower than 1 implies a negative financial performance for that business or individual. A current ratio below one is indicative of one’s inability to pay off the present-time monetary obligations with their assets. This ratio reflects whether an individual or business can pay off short-term dues without any external financial assistance.

Where is liquidity on a balance sheet?

Calculating the liquidity ratio would give a fair idea of a company’s short-term solvency. In the below section, we will take a look at liquidity ratio examples and related real-world case studies to understand them better. While this is the universally accepted formula for this liquidity ratio, there can be different iterations depending on the circumstances. For example, we can include interest and principal payments from the cash flow statement since they are cash expenses. And if the firm has no revenue and stops production, COGS may be excluded from the formula.

What Does the Cash Ratio Measure?

Public companies must find an optimal balance for receivables and payables cycles. Stock investors want to see efficient management of working capital through prudent credit terms. Reliance Industries is an Indian multinational conglomerate company headquartered in Mumbai, Maharashtra. In the financial year 2023, the company reported total current assets of ₹2,55,996 crore, which increased by 2.2% from the previous financial year. The total current liabilities for the year stood at ₹2,37,691 crore, reflecting an increase of 8.5% from fiscal year 2022. An example of a Liquidity Ratio is the Current Ratio, which is calculated by dividing a company’s current assets by its current liabilities.

- Including this will give a ‘blended’ ratio that makes it harder compared to other supermarkets.

- As you can see, this ratio measures the cash availability of the firm to meet the current liabilities.

- Easily convertible (in cash) marketable securities and present holding of cash are considered while calculating the quick ratio.

- For instance, you can compare Microsoft’s current ratio against Google’s current ratio to gauge how each company may be structured differently.

- The metric also fails to incorporate seasonality or the timing of large future cash inflows.

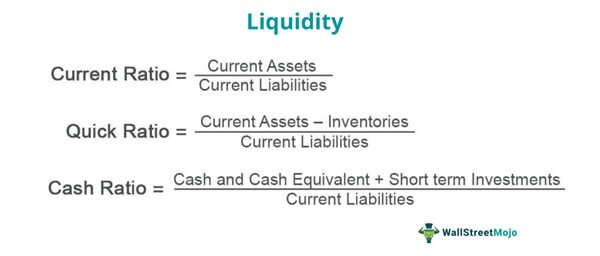

What are the common types of liquidity ratios?

A company can strive to improve its cash ratio by having more cash on hand in case of short-term liquidation or demand for payments. This includes turning over inventory more quickly, holding less inventory, or not prepaying expenses. Evaluating liquidity through current, quick, and cash ratios provides vital insights into a company’s financial health and flexibility. Assessing liquidity trends over time and against competitors allows stakeholders to identify improving or deteriorating liquidity. With a comprehensive understanding of these fundamental ratios, financial analysts and managers can better monitor short-term financial performance. It is not only a measure of how much cash there is but also how easily current assets can be converted to cash or marketable securities.

This reinforces the need for Reliance to bolster its immediate liquidity reserves. The cash ratio was recorded at 0.82, showing a positive improvement over previous years. However, it is still not ideal, and Reliance should consider strategies to build up its readily available cash further.

It is also called the defensive interval period and basic defence interval. As money is the most liquid form of assets, this ratio indicates how quickly and to what limit a company can repay its current dues with the help of its readily available assets. A 1.1 ratio means the company has enough cash to cover current liabilities. Inventory is less liquid than accounts receivable because the product must first be sold before it generates cash (either through a cash sale or sale on account).

Companies are using different kinds of treasury software to manage their Liquidity Ratios and ensure that they are in a healthy financial position. It gives them a clear view of their liquidity ratio and helps them take corrective action if it is not within the desired range. A higher number indicates that a company has more liquid assets to cover its short-term debt, while a lower number suggests its liquidity position may be jeopardized. The current ratio includes all current assets that can be converted into cash within one year and all current liabilities with maturities within one year.

A higher liquidity ratio indicates a company is more liquid and has a greater ability to meet its short-term obligations. However, the Ratio cannot go negative accounts receivable vs payable: differences and definition 2023 as the assets and liabilities are not negative values. Even if a company has zero current assets, the ratio ratio would be 0, which is not a negative number.

Fundamentally, all liquidity ratios measure a firm’s ability to cover short-term obligations by dividing current assets by current liabilities (CL). Short term liquidity ratio is a company’s ability to meet its short-term financial requirements without requiring external capital. Short term liquidity ratio generally measures the balance between a company’s current liabilities and current assets. Current liabilities can be in the form of trade creditors, VAT, bank overdrafts, etc. and current assets will be stocks, cash, etc.

JAN

About the Author